Trade Something

Trade Something

Trade crypto by chatting with AI.

Vibetrading

Submit prompts, not orders.

Buy Large Dips.

"Enter long positions only during significant pullbacks within a strong trend. Entry Criteria: - RSI is oversold - CCI is low - ADX is high, confirming a strong trend - Price is at least 2 ATR below the EMA - Daily price change is negative - Bid-ask spread is narrow Exit Criteria: - RSI recovers to neutral - MACD turns bearish Risk Management: - Maximum position size: $14,500"

Volatility-Based Breakout.

"Enter positions when price breaks out of a range with significant volatility expansion. Entry Criteria: - Price breaks above a defined resistance or below support level - Recent volatility (e.g., ATR) is above its moving average - Volume increases significantly on breakout - RSI is above 50 (for long) or below 50 (for short) - ADX is above 25, confirming strong trend potential - MACD is bullish (for long) or bearish (for short) - Bid-ask spread is narrow Exit Criteria: - Price enters consolidation after breakout - MACD shows signs of divergence or turns neutral - RSI reaches extreme overbought/oversold levels Risk Management: - Use stop-loss based on ATR (e.g., 1.5x ATR below breakout level for long) - Maximum position size: $14,500"

Trend Following.

"Enter positions in the direction of the prevailing trend. Entry Criteria: - Price is above 50-period EMA (for long) or below 50-period EMA (for short) - ADX is above 25, indicating a strong trend - RSI is above 50 (for long) or below 50 (for short) - MACD is bullish (for long) or bearish (for short) - Bid-ask spread is narrow Exit Criteria: - Trend shows signs of reversal (e.g., price breaks EMA) - MACD crosses to neutral or bearish for long positions - RSI falls below 50 for long positions (or rises above 50 for short) Risk Management: - Use trailing stop-loss to lock in profits - Maximum position size: $14,500"

Trade Breakouts.

"Enter positions when price breaks out of consolidation with strong momentum. Entry Criteria: - Price breaks above a well-defined resistance level - Volume expands above average - ADX is high, confirming a strong trend - RSI is above neutral and rising - MACD is bullish - Bid-ask spread is narrow Exit Criteria: - Momentum weakens or stalls - MACD turns bearish - Price falls back below the breakout level Risk Management: - Use predefined stop-loss below the breakout level - Maximum position size: $10,500"

Mean Reversion Shorting.

"Enter short positions when price deviates significantly from the mean and is likely to revert back. Entry Criteria: - Price is significantly above a moving average (e.g., 20-period EMA) - RSI is overbought (above 70) - CCI is high, indicating overextension - MACD is bearish - Price shows signs of exhaustion (e.g., candlestick reversal patterns) - Bid-ask spread is narrow Exit Criteria: - Price approaches or reverts to the moving average - RSI returns to neutral (below 70) - MACD turns bullish or shows divergence Risk Management: - Use stop-loss above a recent swing high or a multiple of ATR - Maximum position size: $14,500"

Volatility Scalping.

"Enter positions during periods of high volatility to capture quick, small price movements. Entry Criteria: - ATR (Average True Range) is above its moving average, indicating high volatility - Price breaks above/below a short-term support/resistance level - RSI is neutral (between 40-60) to avoid overbought/oversold conditions - Volume spikes, confirming increased market activity - Bid-ask spread is narrow Exit Criteria: - Target small, fixed profit (e.g., 0.2% - 0.5% move) - Or price moves against position by a small amount (e.g., 0.2% - 0.3%) Risk Management: - Tight stop-loss based on recent volatility (e.g., 0.5x ATR) - Maximum position size: $14,500"

Try Vibetrading

Describe any trading strategy and watch AI trade it.

Trade With AI

Prompt yourself to profitability.

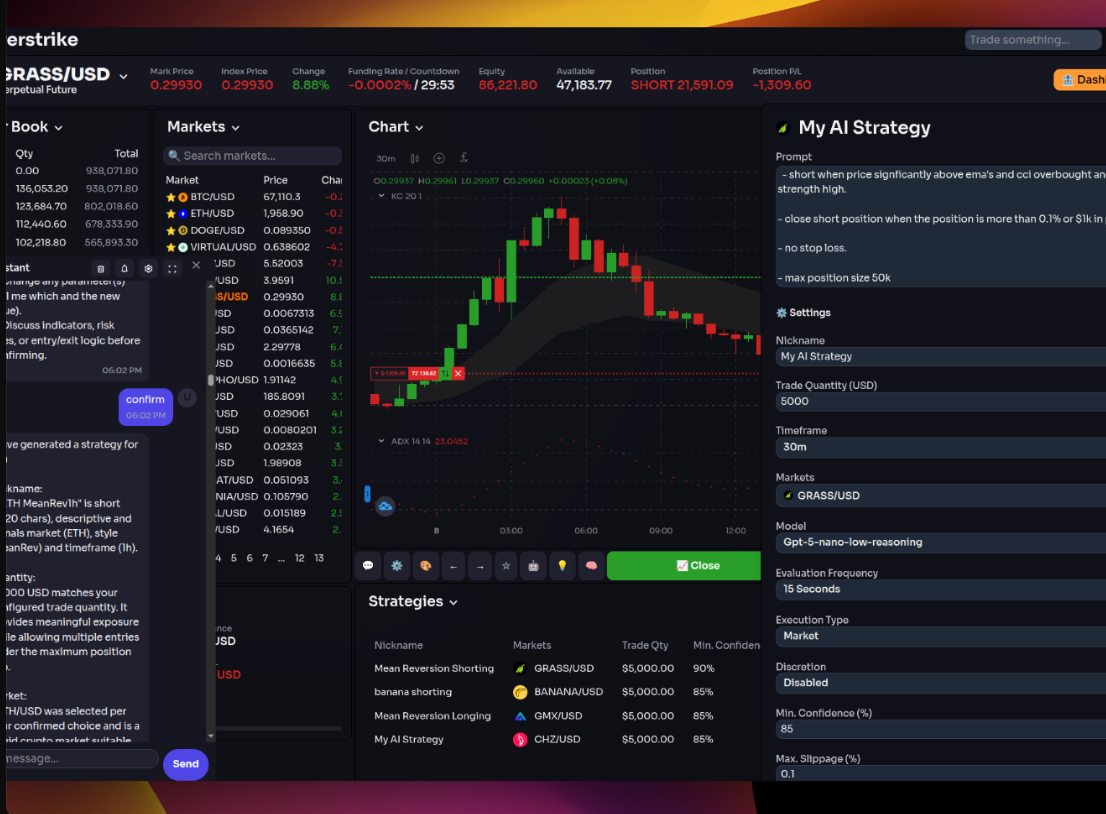

Text Trading

Describe your trading goals in text and let AI accomplish them for you.

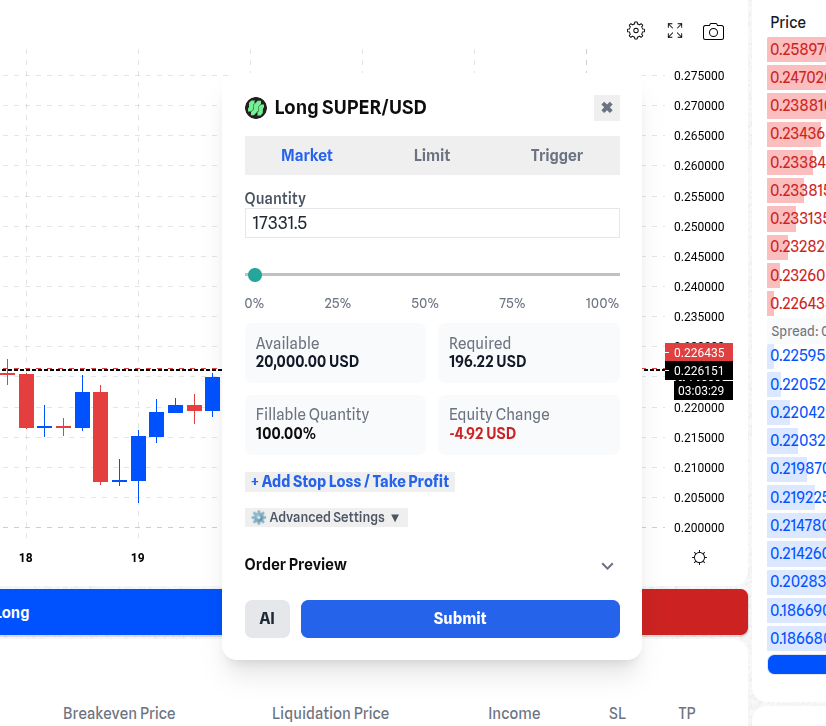

Simple Tasks

Ask your AI to do simple things like closing your position when you are X dollars in profit

Complex Strategies

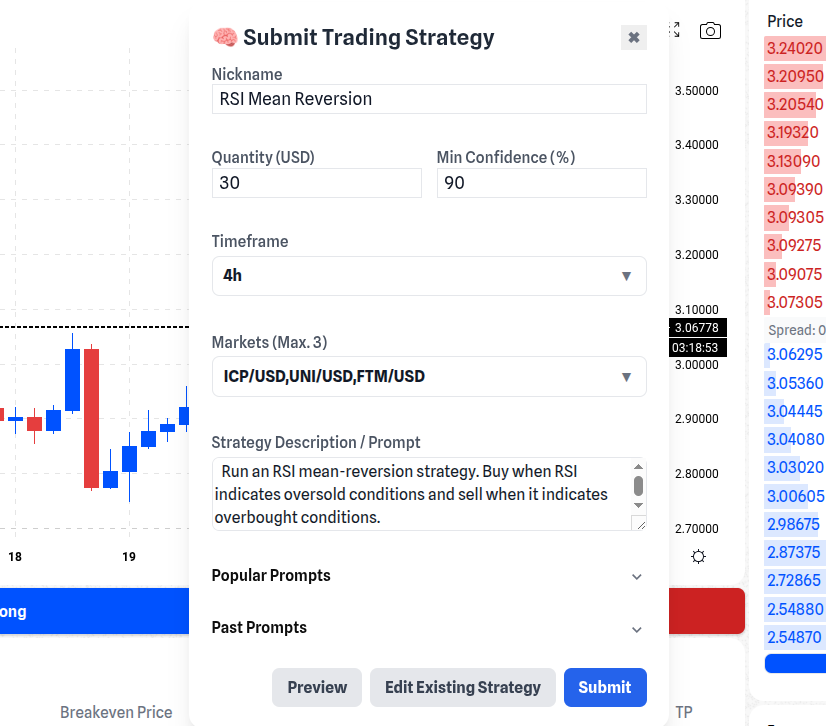

Run complex trading strategies involving technical, statistical and L1 orderbook data

Strategy Development

Don't have a strategy? Brainstorm with AI and come up with a strategy together

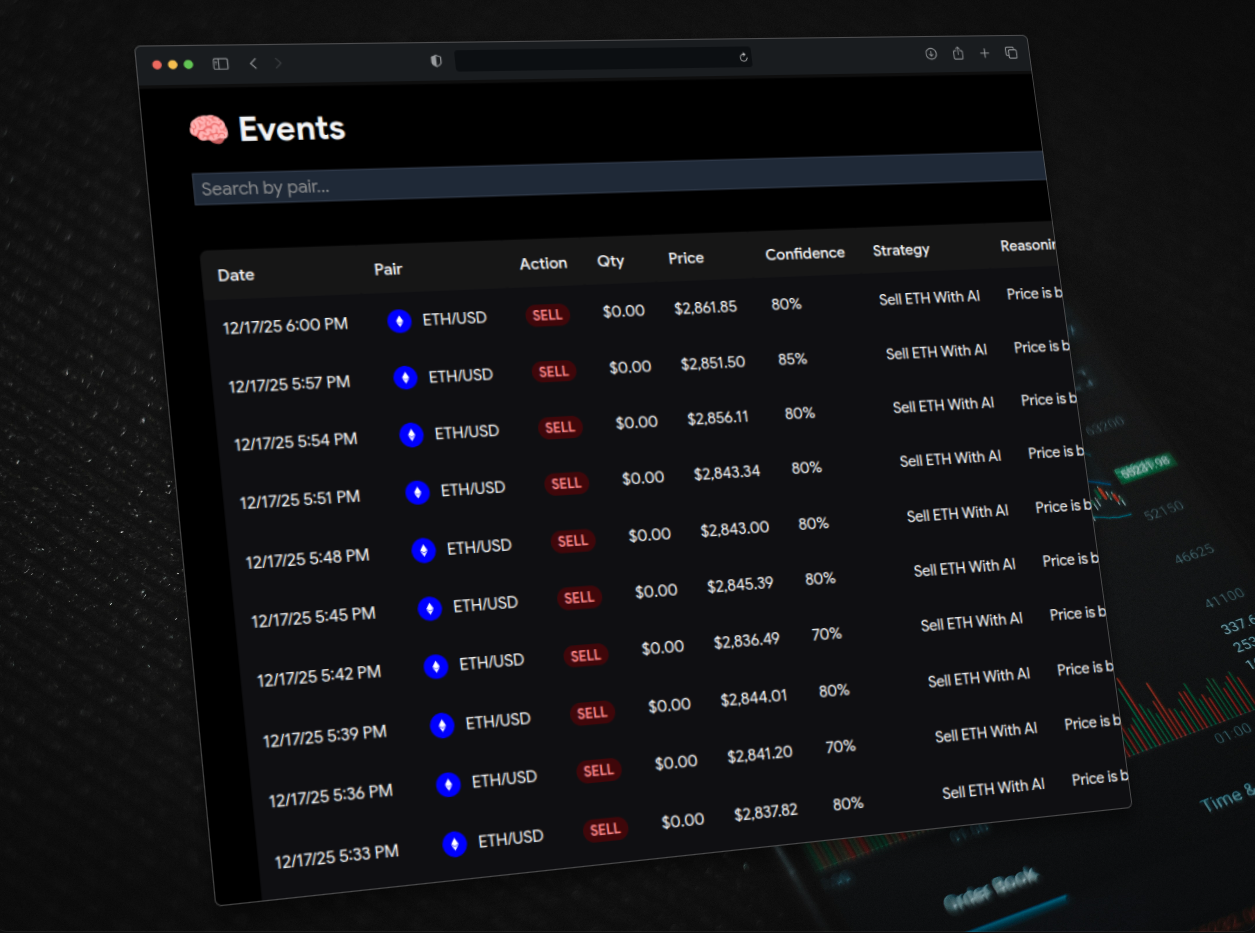

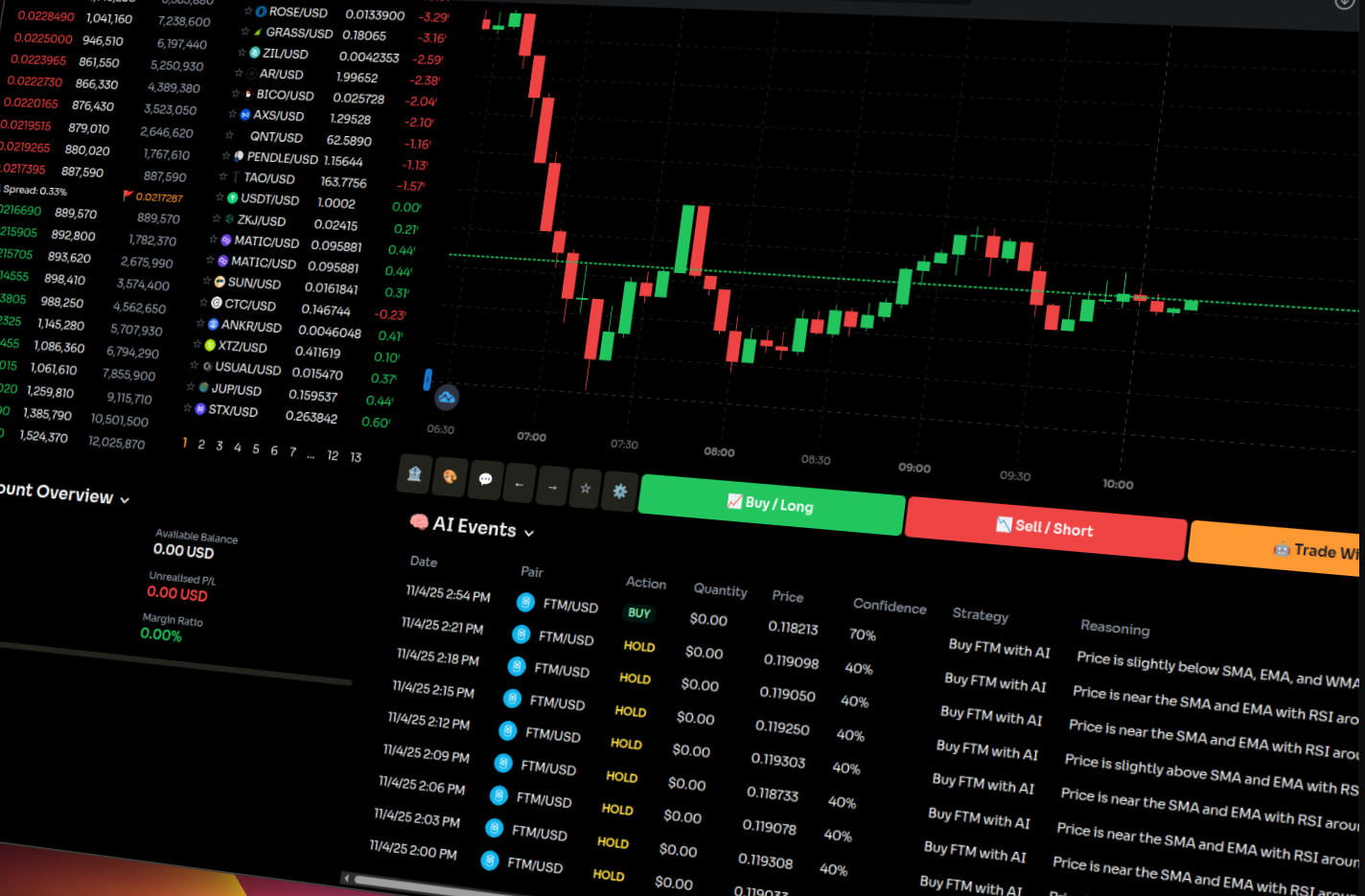

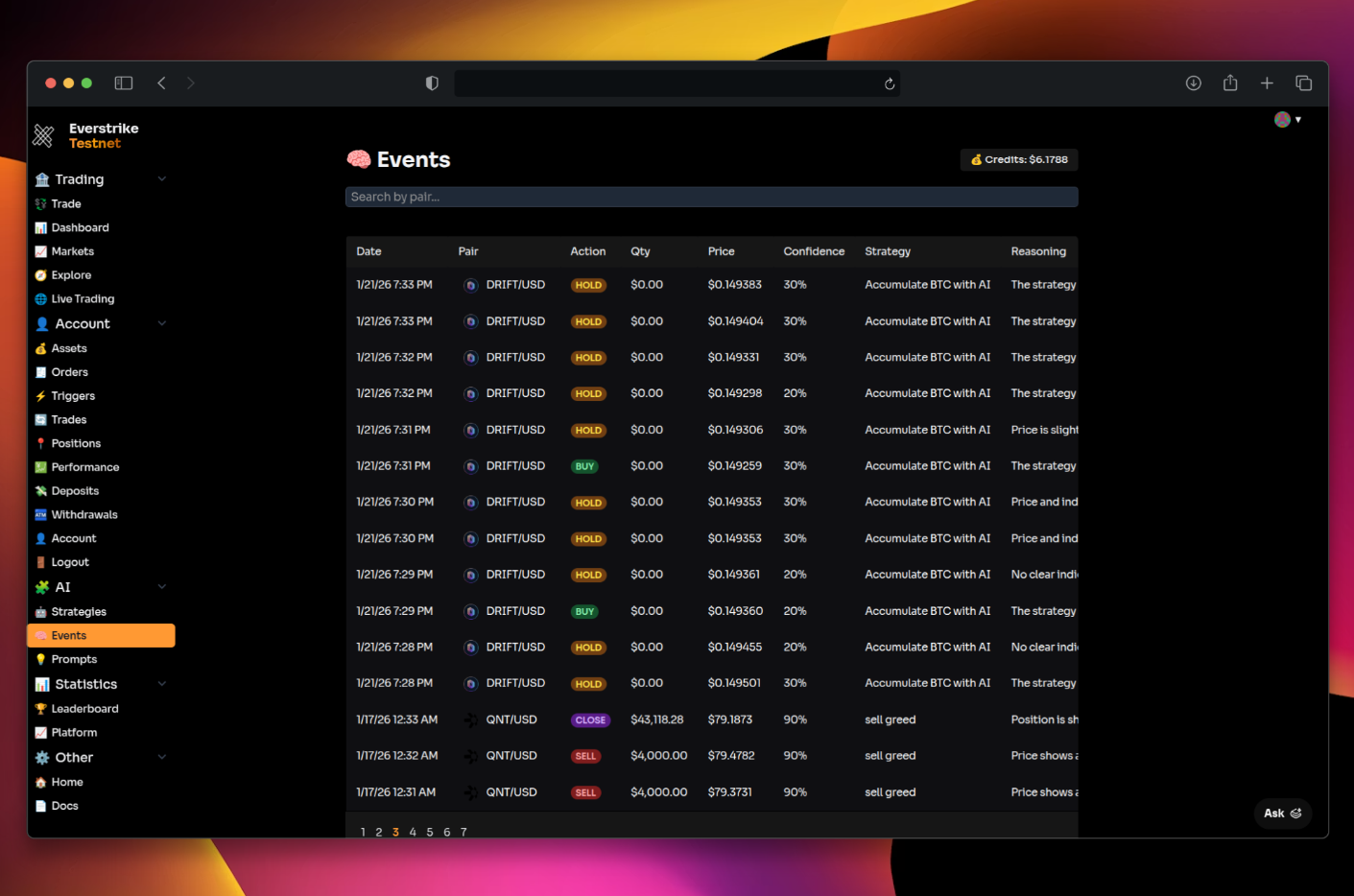

Events & Insights

Debug exactly what your AI is doing and why it is doing it. Events give you complete insight into your AI.

Confidence Level

Explore how confident the AI was in its decision

Reasoning

Explore what led the AI to its decision

Cost

View model usage and tokens consumed

Customization

Customize the parameters of your AI and the model that it uses behind the scenes. Coming soon.

Model Selection

Effortlessly switch between between Claude, GPT, DeepSeek, Gemini and other LLM's

AI Parameters

Customize key parameters such as minimum confidence level and temperature

AI Input Data

Customize the data that your AI processes, reducing costs and improving accuracy

Try It Risk-Free

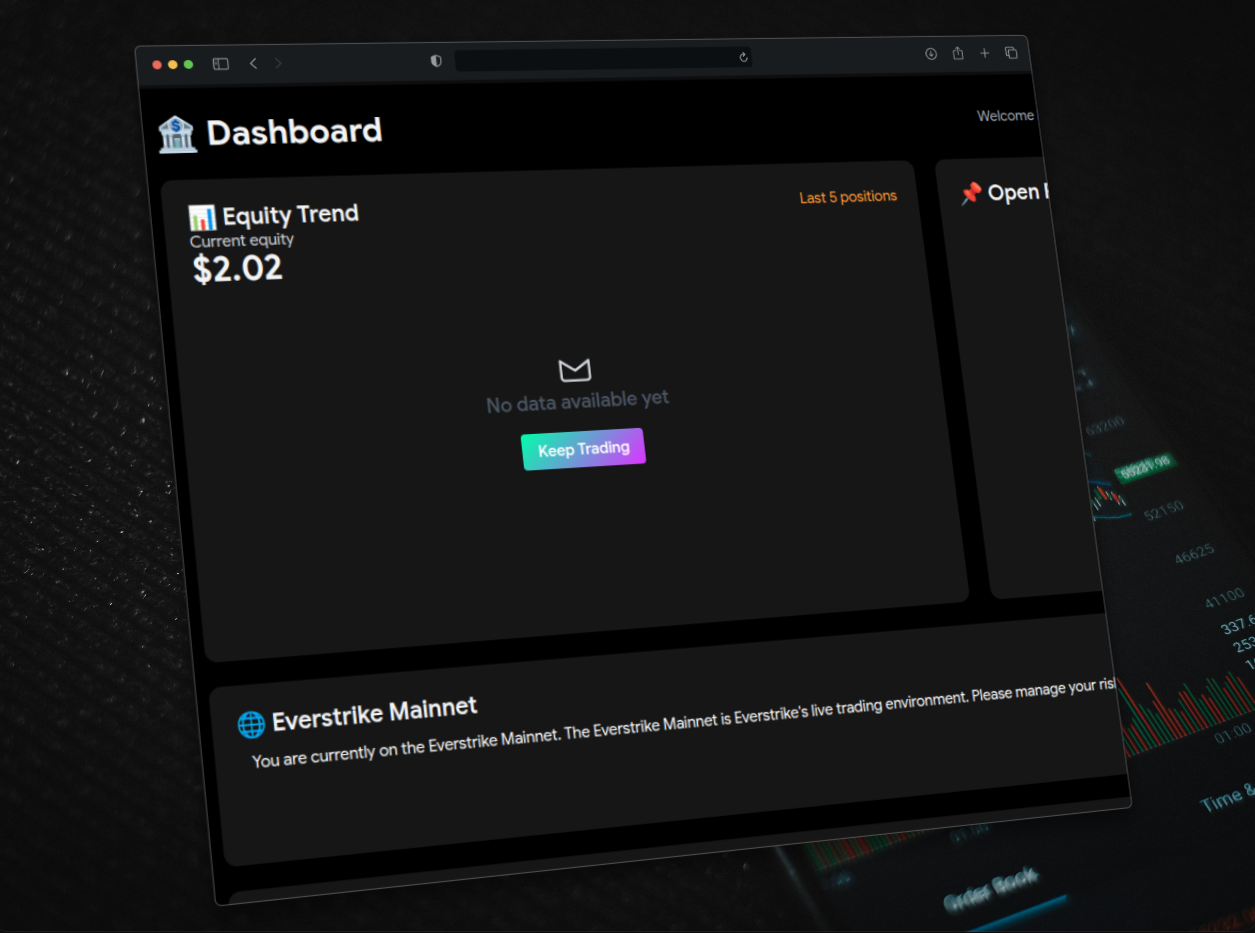

Start vibetrading right away. No deposit required. No purchase of AI credits required. No wallet connection required. Only deposit if you make money.

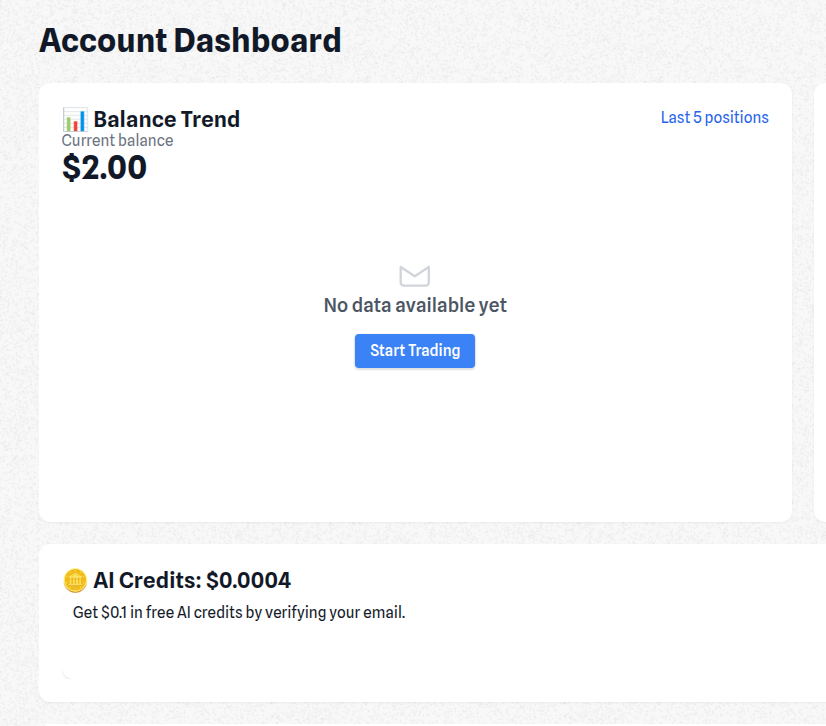

- Free Starting BalanceFree 2 USD starting balance which can be used for initial testing. You can leverage it up to 100x and withdraw all of the profits you make from trading with it. It's basically free money!

- Free AI CreditsStart vibetrading right away with 0.5 USD in free AI credits. Enough for 24 hours of uninterrupted strategy evaluation. Add more when you need it.

- Demo TradingTry out demo trading on the Everstrike Testnet with a $20k demo balance. No signup needed.

Market Movers

LiveCrypto Market Cap

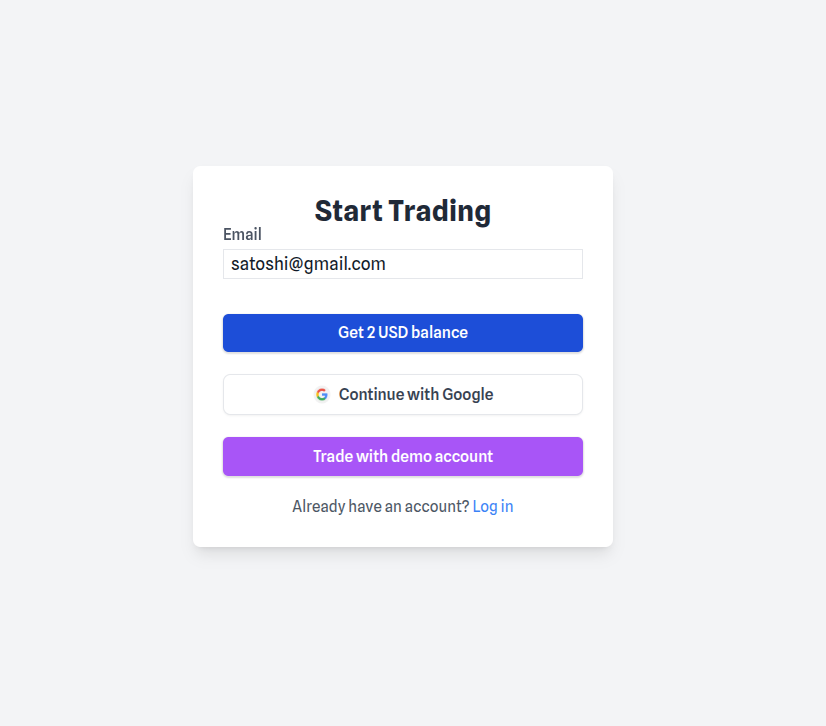

Get Started In Seconds

Begin your vibetrading journey in 30 seconds.

Create Your Account

Sign up in seconds with just your email. Or trade on testnet without an account.

Verify Your Email

Verify your email address by clicking the link that is sent to your inbox.

Start Trading

Use your free 2 USD starting balance to start vibetrading.

Scale & Grow

Deposit funds and grow your account balance.

How It Works

Start vibetrading in four simple steps.

Create Your Account

Sign up in seconds with just your email. Or trade on testnet without an account.

Trade With Your Free Balance

Your account is automatically credited a 2 USD balance on signup. This enables you to start trading without making a deposit. You'll also receive some free AI credits.

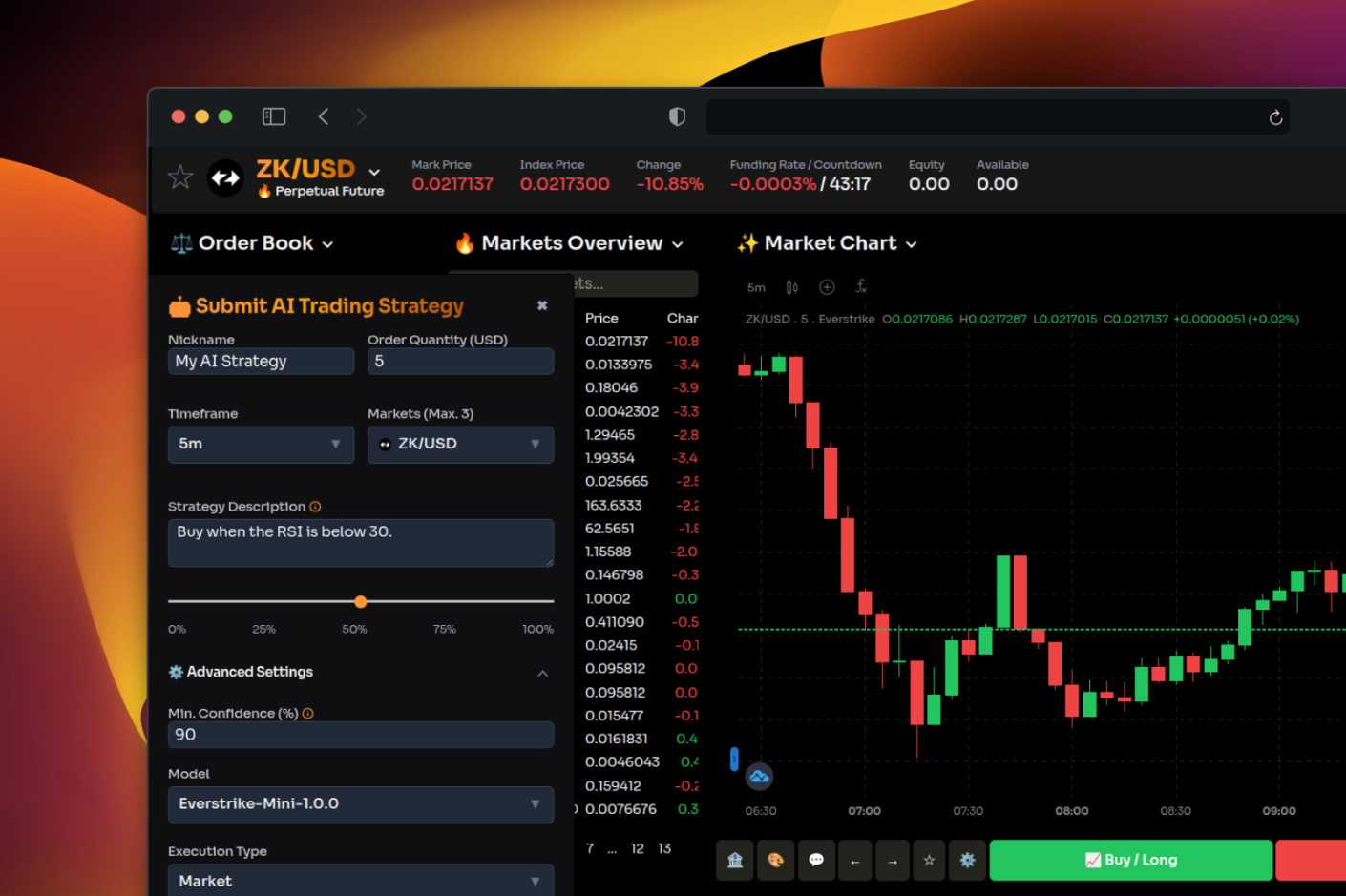

Submit Your First AI Strategy

Write a prompt that tells the AI what to do. Or use one of the built-in prompts.

Watch The AI Trade

Watch the AI make decisions and execute trades on your behalf.

Frequently Asked Questions

Everything you need to know about trading on Everstrike.

Ready To Start Vibetrading?

Click one of the buttons below to get a free starting balance.

Live account includes a 2 USD real balance • Demo account includes a 20,000 USD test balance